Bioethanol Market Size to Expected to Reach USD 86.5 Bn by 2034 Rising Demand for Renewable Energy and Supportive Government Policies

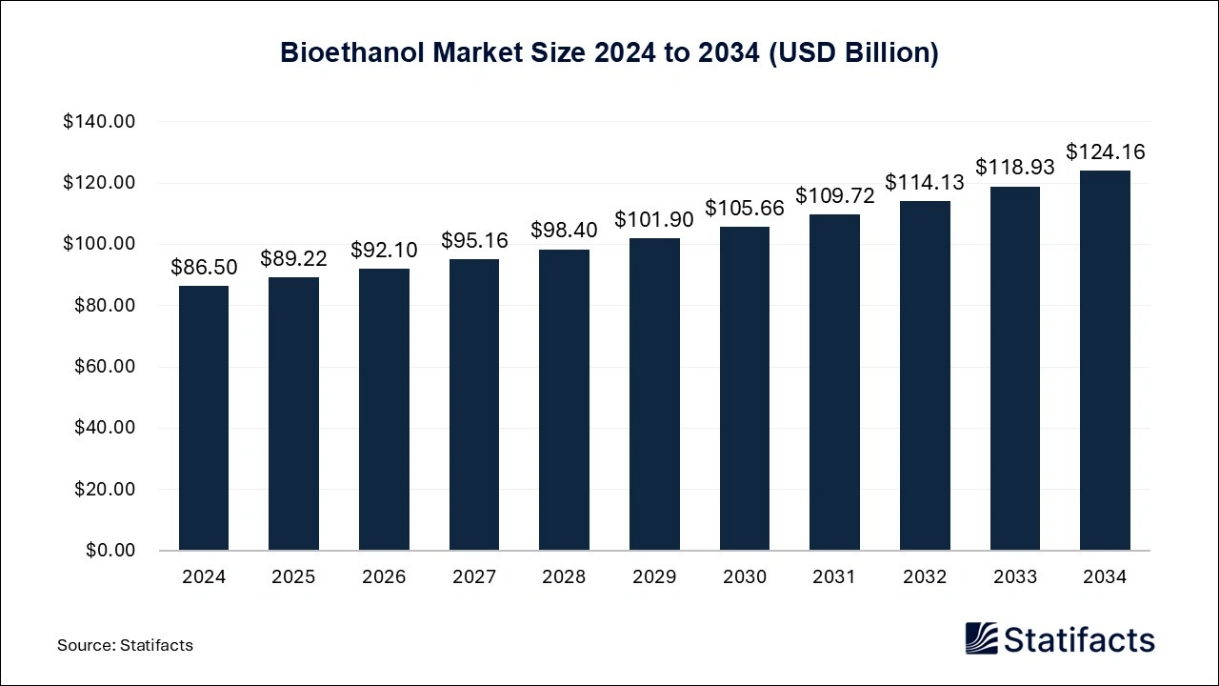

The global bioethanol market size is predicted to increase from USD 89.22 billion in 2025 and is estimated to hit around USD 124.16 billion by 2034, growing at a CAGR of 3.68% from 2025 to 2034. A study published by Statifacts a sister firm of Precedence Research.

Ottawa, Sept. 15, 2025 (GLOBE NEWSWIRE) -- According to Statifacts, the global bioethanol market size was exhibited at USD 86.5 billion in 2024 and anticipated to be worth around USD 109.72 million by 2031, accelerating a CAGR of 3.68% during the forecast period 2025 to 2034. Government initiatives for research endeavors and favorable regulatory measures, growing dependence on reducing greenhouse gas emissions, and rising popularity as an eco-friendly fuel for road transportation are driving the growth of the market.

This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Try Before You Buy – Get the Sample Report@ https://www.statifacts.com/stats/databook-download/8454

Bioethanol Market Highlights

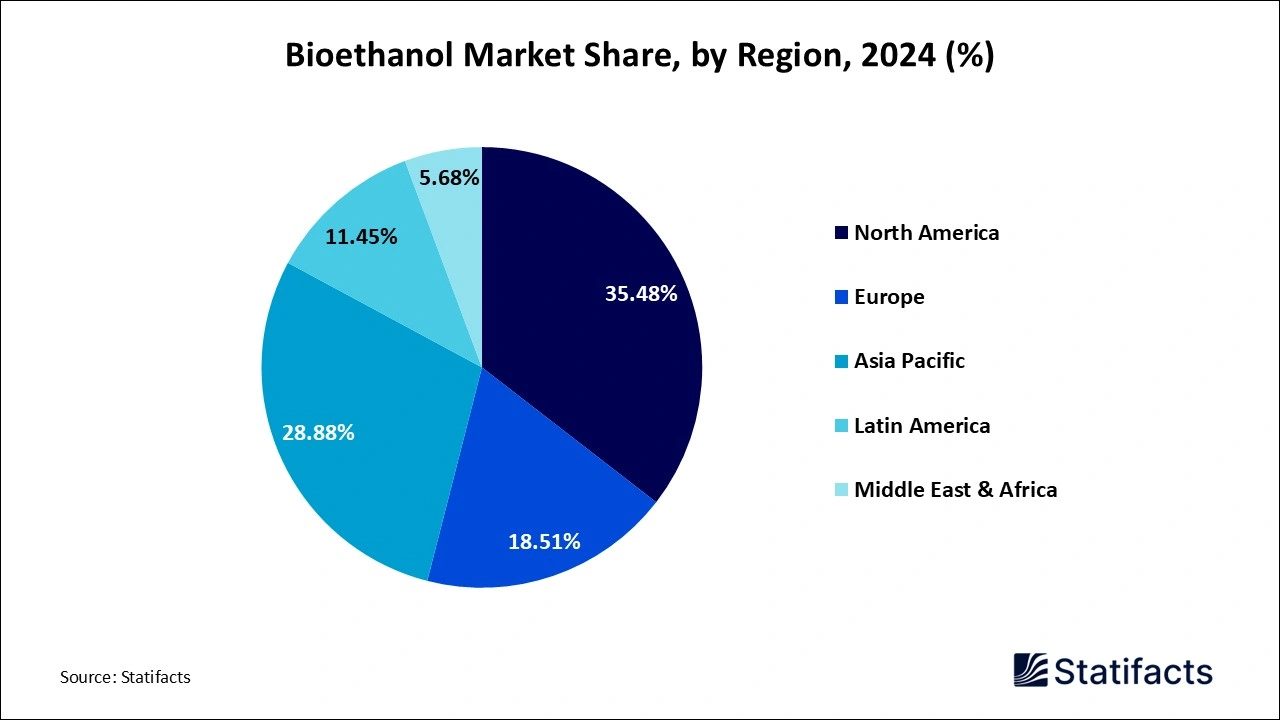

- North America dominated the global bioethanol market with the largest market share of 35.48% in 2024.

- Asia-Pacific is projected to experience the fastest growth rate from 2025 to 2034.

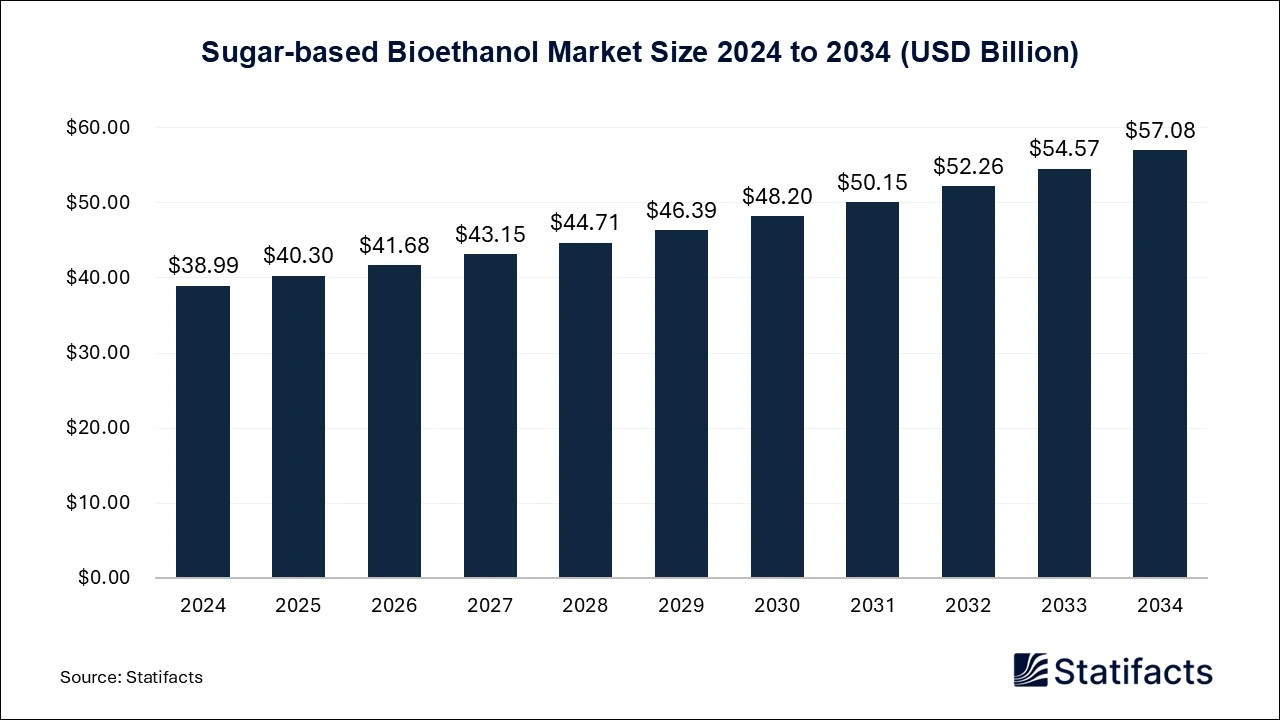

- Sugar-based Bioethanol dominated the market, accounting for the largest share in 2024.

- E10 (10% Ethanol, 90% Gasoline) held the dominant share in 2024, leading the blend type segment.

- Wet Milling was the dominant production technology in 2024, capturing the largest market share.

- Transportation dominated the end-use industry, accounting for the largest share in 2024.

- Retail Fuel Stations held the largest market in 2024, leading the distribution channel segment.

Bioethanol Market Size by Feedstock Type, 2023 to 2034 (USD Million)

| Segments | 2023 | 2024 | 2025 | 2034 |

| Sugar-based Bioethanol | 37,668.2 | 38,990.9 | 40,299.0 | 57,078.7 |

| Starch-based Bioethanol | 20,259.9 | 20,951.8 | 21,634.6 | 30,391.3 |

| Cellulosic Bioethanol | 15,664.3 | 16,137.9 | 16,600.6 | 22,527.5 |

| Algal Bioethanol | 10,139.6 | 10,419.5 | 10,690.6 | 14,160.6 |

Bioethanol Market Size by Blend Type, 2023 to 2034 (USD Million)

| Segments | 2023 | 2024 | 2025 | 2034 |

| E5 (5% Ethanol, 95% Gasoline) | 9,063.3 | 9,319.8 | 9,568.9 | 12,758.0 |

| E10 (10% Ethanol, 90% Gasoline) | 42,693.1 | 44,239.7 | 45,772.9 | 65,450.6 |

| E15 (15% Ethanol, 85% Gasoline) | 19,360.0 | 20,012.4 | 20,655.6 | 28,901.1 |

| E85 (85% Ethanol, 15% Gasoline) | 8,111.5 | 8,331.2 | 8,543.7 | 11,257.9 |

| E100 (100% Ethanol, Flex-fuel vehicles) | 4,504.2 | 4,596.8 | 4,683.6 | 5,790.4 |

Bioethanol Market Size by Production Technology, 2023 to 2034 (USD Million)

| Segments | 2023 | 2024 | 2025 | 2034 |

| Dry Milling | 10,227.2 | 10,542.1 | 10,850.2 | 14,797.2 |

| Wet Milling | 44,992.6 | 46,561.1 | 48,111.4 | 67,996.4 |

| Cellulosic Fermentation | 23,225.6 | 23,971.4 | 24,703.8 | 34,092.4 |

| Gasification and Fermentation | 5,286.6 | 5,425.5 | 5,559.4 | 7,272.1 |

Bioethanol Market Size by End-Use Industry, 2023 to 2034 (USD Million)

| Segments | 2023 | 2024 | 2025 | 2034 |

| Transportation | 46,467.2 | 48,106.7 | 49,728.7 | 71,069.3 |

| Power Generation (Ethanol-based Power Plants) | 14,066.2 | 6,800.6 | 15,035.6 | 21,173.4 |

| Pharmaceuticals & Personal Care | 6,800.6 | 6,979.6 | 7,152.2 | 9,178.9 |

| Food & Beverages | 5,328.4 | 5,485.2 | 5,638.0 | 7,394.1 |

| Chemical Industry | 11,069.5 | 11,374.7 | 11,670.3 | 15,342.5 |

Bioethanol Market Size by Distribution Channel, 2023 to 2034 (USD Million)

| Segments | 2023 | 2024 | 2025 | 2034 |

| Direct Sales | 18,170.3 | 18,763.9 | 19,347.7 | 26,829.4 |

| Third-Party Distributors | 16,216.8 | 16,711.5 | 17,195.3 | 23,398.7 |

| Retail Fuel Stations | 46,040.3 | 47,681.3 | 49,305.9 | 70,146.3 |

| Online Sales | 3,304.6 | 3,343.3 | 3,375.8 | 3,783.7 |

Market Overview and Industry Potential

The bioethanol market refers to the production, distribution, and use of bioethanol, which is a type of alcohol that is obtained from different types of plants rich in cellulose, like sugarcane, sugar beet, and some grains like corn. Bioethanol has many benefits, including its renewability, biodegradability, and importance in reducing greenhouse gas emissions. More complete combustion makes it a much cleaner exhaust than gasoline.

There are many sources for this fuel as long as they contain starch or sugar. According to a report published in June 2025, a pilot facility in Fukushima Prefecture to produce second-generation bioethanol from non-edible biomass was launched by Toyota in partnership with other Japanese Manufacturers. The plant is designed to generate around 60 kiloliters of ethanol annually, and uses agricultural residues like rice straw and forestry by-products.

Source: Bioenergy

Artificial intelligence (AI)’s role in biofuels provides an emerging and significant convergence in the relationship between advanced technology and energy produced from renewable sources. AI in biofuels is used for improving the biofuel production by adjusting irrigation and fertilizer usage to maximize yield, and conversion processes like adjusting temperature and pressure levels, to enhance the efficiency of biofuels. AI techniques in bioethanol production do not require major technological changes in current automobile engine systems. AI improves bioenergy, improves efficiency, and reduces waste.

Sugar-based Bioethanol Market Size 2024 to 2034 (USD Billion)

A related Statifacts report on the sugar-based bioethanol market highlights that the market surpassed USD 38.99 million in 2024 and is expected to reach around USD 57.08 million by 2031, also growing at a CAGR of 3.88% from 2025 to 2034. Sugar-based bioethanol is a renewable fuel made from sugar crops like sugarcane. The market is growing due to environmental policies and demand for cleaner fuels. Key challenges include price fluctuationsand food vs. fuel concerns.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Try Before You Buy – Get the Sample Report@ https://www.statifacts.com/stats/databook-download/8491

Case Study: Toyota’s Fukushima Pilot Plant for Second-Generation Bioethanol (Japan, June 2025)

Overview:

In June 2025, Toyota, in collaboration with other Japanese manufacturers, launched a pilot facility in Fukushima Prefecture to produce second-generation bioethanol. Unlike first-generation bioethanol (produced from food crops like corn or sugarcane), this plant uses non-edible biomass such as rice straw and forestry residues, with an annual production capacity of 60 kiloliters.

Why it Matters:

- Innovation in Sustainability: The project addresses food vs. fuel concerns by focusing on agricultural and forestry waste, making it more environmentally sustainable.

- Policy Alignment: Japan is under pressure to reduce greenhouse gas emissions, and this facility directly supports the country’s clean energy targets.

- Tech Integration: The pilot highlights how traditional automotive leaders like Toyota are exploring multiple green pathways beyond electric vehicles to secure future energy diversity.

- Global Relevance: It echoes the broader trend mentioned in your press release: governments and industries worldwide investing in second-generation biofuels as a key decarbonization tool.

The facility is projected to reduce lifecycle carbon emissions by up to 80–90% compared with conventional gasoline use.

Major Applications of Bioethanol

-

Transportation Fuel

Bioethanol is blended with gasoline (e.g., E10, E85) to reduce greenhouse gas emissions and enhance octane ratings, making vehicles run cleaner and more efficiently.

-

Alcoholic Beverages

Used as the main alcohol ingredient in spirits, liquors, and other alcoholic drinks due to its purity and safety for consumption.

-

Pharmaceuticals

Serves as a solvent and antiseptic in medications, tinctures, and disinfectants, ensuring product safety and efficacy.

-

Personal Care Products

Incorporated in hand sanitizers, perfumes, and cosmetics for its antiseptic properties and ability to dissolve ingredients.

-

Industrial Solvent

Used in manufacturing paints, coatings, and cleaning agents due to its effective dissolving properties and biodegradability.

-

Power Generation

Employed as a renewable fuel in boilers and generators, helping reduce reliance on fossil fuels in energy production.

-

Chemical Feedstock

Acts as a raw material to produce other chemicals like ethyl acetate, acetic acid, and butanol, used across industries.

-

Household Products

Found in detergents, disinfectants, and air fresheners, providing cleaning and antimicrobial functions.

Key Market Trends

- Rising Demand for Renewable Fuels – Increasing government mandates and policies worldwide to reduce greenhouse gas emissions are boosting bioethanol use as a cleaner alternative to fossil fuels.

- Technological Advancements – Innovations in bioethanol production, such as second-generation bioethanol from non-food biomass and improved fermentation technologies, are enhancing efficiency and sustainability.

- Growing Food & Beverage Applications – Expanding use of food-grade ethanol in alcoholic beverages, flavorings, and food processing is increasing demand beyond just fuel uses.

- Feedstock Diversification – The industry is exploring alternative feedstocks like agricultural residues, waste materials, and cellulosic biomass to reduce dependence on food crops and improve sustainability.

-

Rising Consumer Awareness & Environmental Concerns – Increasing consumer preference for eco-friendly products and cleaner energy sources is encouraging investments and market growth in bioethanol production and applications.

Proof-Point Micro-Stats: More than 70 countries have implemented ethanol blending mandates at E10 or higher. Global ethanol trade exceeded 10 billion liters in 2023, led by the U.S. and Brazil.

Customize This Study as Per Your Requirement@ https://www.statifacts.com/stats/customization/8454

Bioethanol Market Dynamics

Market Drivers

- Growing demand for reducing greenhouse gas emissions: On a lifecycle analysis basis, greenhouse gas (GHG) emissions are reduced on average by 40% with corn-based ethanol produced from dry mills, and reductions range between 88% and 108% if cellulosic feedstocks are used, depending on feedstock type, compared with gasoline and diesel production and use. When we use bioethanol instead of gasoline, it helps to reduce atmospheric CO2 in 3-ways: avoiding the emissions associated with gasoline, the CO2 content of the fossil fuels remaining in storage, and providing a mechanism for CO2 absorption by growing new biomass for fuels.

- Rising popularity as an eco-friendly fuel for road transportation: Ethanol is a green fuel that produces fewer harmful emissions by reducing air pollution and contributes to enhancing air quality. It creates a closed carbon cycle, which reduces pollution and makes the country greener. Bioethanol can be used in the transport sector after blending with gasoline in order to minimize gasoline consumption and associated economic and environmental impacts. Bioethanol is produced by fermentation of renewable biomass; its use can significantly reduce fossil fuel use and greenhouse gas emissions.

Market Restraint

-

Competition from electric vehicles: Bioethanol faces challenges as compared to electric vehicles, including lower energy content, potential competition with food production, high land and water use for feedstock crops, and the need for engine modifications and specialized infrastructure. In terms of greenhouse gas (GHG) emissions, biofuel-powered vehicles are considered carbon neutral, but they emit other pollutants. All forms of electric vehicles (EVs) can help improve fuel economy, lower fuel costs, and reduce emissions. Using electricity as a power source for transportation improves public health and the environment, provides safety benefits, and contributes to a resilient transportation system.

Market Opportunity

-

Development of second-generation biofuels: Second-generation biofuels can solve these problems and can supply a larger proportion of biofuel sustainability and affordability with greater environmental benefits. Second-generation biofuel technologies have been developed to allow the use of non-food biofuel feedstocks because of concerns about food security caused by the use of food crops for the production of first-generation biofuels. Second-generation biofuels offer reduced competition with food crops and improved sustainability by using waste materials.

Ready to Dive Deeper? Visit Here to Buy Databook & In-depth Report Now@ https://www.statifacts.com/order-databook/8454

Bioethanol Market Scope

| Report Attribute | Key Statistics | |

| Market Size in 2023 | USD 83.73 Billion | |

| Market Size in 2024 | USD 86.50 Billion | |

| Market Size in 2025 | USD 89.22 Billion | |

| Market Size in 2028 | USD 98.40 Billion | |

| Market Size in 2032 | USD 114.13 Billion | |

| Market Size by 2034 | USD 124.16 Billion | |

| CAGR 2025-2034 | 3.68% | |

| Leading Region in 2024 | North America | |

| Fastest Growing Region | Asia-Pacific | |

| Base Year | 2024 | |

| Forecast Period | 2025 to 2034 | |

| Segments Covered | By Feedstock Type, By Blend Type, By Production Technology, By End-Use Industry, By Distribution Channel, and By Region | |

| Regional analysis | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa | |

| Leading Players | Archer Daniels Midland, POET LLC, Green Plains, Valero Energy Corporation, Tereos (France), Raizen, Flint Hills Resources, Pacific Ethanol, The Andersons Inc., Sekab Biofuels & Chemicals AB, and Others. | |

Bioethanol Market Segmentation

Feedstock Type Insights

The starch-based segment held a dominant presence in the bioethanol market in 2024 because starch is transforming the biofuel industry by exploring its potential and impact on sustainable energy. Bioethanol is derived from sugars through microbial fermentation. Currently, most ethanol is produced from starch-based crops by dry- or wet-mill processing, except Brazil, which mainly uses sugarcane for bioethanol production. The benefits of triticale and sorghum can be amplified with raw starch fermentation strategies that may reduce the energy needs.

The cellulose-based segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034 because cellulosic biofuel sources offer a substantially greater energy return on investment compared to grain-based sources. Cellulosic ethanol improves the energy balance of ethanol because the feedstocks are either waste, coproducts of another industry, or dedicated crops like switchgrass and miscanthus with lower water and fertilizer needs compared to corn.

Blend Type Insights

The E-10 segment accounted for a considerable share of the bioethanol market in 2024 because E-10 blend-type biofuel is made up of 90% regular unleaded and 10% ethanol. The standard unleaded fuel used until E10’s introduction contained up to 5% ethanol and can be used in any petrol-engined car without problems or the need for modification. The use of E10 provides society with “environmental benefits” compared to the use of E5 petrol. Renewable bioethanol, which is used in E10, reduces greenhouse gas emissions compared to petrol without bioethanol.

- In June 2025, Vietnam prepared to introduce E10 gasoline nationwide from January 2026. The Ministry of Industry and Trade, on June 25, 2025, organized a mid-year review conference on fuel supply and strategic plans for the second half of 2025, highlighting this announcement.

The E15 to E70 segment is projected to experience the highest growth rate in the market between 2025 and 2034. E15 to E70 are biofuel blends that contribute to an earth-friendly approach to fuel consumption. That is because they are each a blend of regular gasoline and ethanol, a renewable resource derived from corn or other plant materials, which helps to reduce greenhouse gas emissions compared to traditional gasoline.

Production Technology Insights

The dry milling segment dominated the market because the dry milling process is relatively efficient. Dry milling is the most common process used for bioethanol production because of the low capital costs needed to build and operate these plants. Dry milling machines are designed to use minimal energy, and the process is relatively quick. This makes it a cost-effective solution for many manufacturing applications. The ability to control the final product’s quality and consistency.

The cellulosic fermentation segment is anticipated to grow with the highest CAGR in the market during the studied years because cellulosic ethanol can reduce greenhouse gas emissions by 85% over reformulated gasoline. Cocultivation of cellulolytic and saccharolytic microbial populations is a promising strategy to improve bioethanol production from recalcitrant cellulosic materials fermentation.

End-use Industry Insights

The transportation segment led the bioethanol market because replacing fossil fuels with biofuels has the potential to reduce some undesirable environmental impacts of fossil fuel production and use, including conventional and greenhouse gas (GHG) pollutant emissions, exhaustible resource depletion, and dependence on unstable foreign suppliers. Another benefit of bioethanol is the ease with which it can be integrated into the existing road transport fuel system.

The Food & beverages segment is the second-largest segment, leading the market by fueling demand for high-purity, food-grade ethanol used in alcoholic beverages, flavorings, food preservation, and extracts. While transportation fuel remains the largest consumer of bioethanol by volume, the Food & Beverages sector dominates among non-fuel applications due to its consistent demand, strict quality standards, and rising consumer preferences for natural ingredients and premium alcoholic products.

Distribution Channel

The third-party distributors segment is dominating the market by acting as crucial intermediaries that connect producers with diverse end-users across industries, including fuel, food & beverages, and pharmaceuticals. Their extensive distribution networks enable efficient supply chain management, ensuring timely delivery and consistent product availability, which helps expand market reach geographically and across sectors. Additionally, third-party distributors offer value-added services like storage, quality control, and regulatory compliance support, making it easier for smaller manufacturers and end-users to access bioethanol products without large-scale infrastructure investments, thereby driving overall market growth and penetration.

The direct sales segment is expected to grow fastest over the forecast period in the market by enabling producers to establish close relationships with large-scale end-users such as fuel companies, beverage manufacturers, and industrial clients, ensuring tailored supply agreements and better pricing control. This approach reduces reliance on intermediaries, lowers distribution costs, and allows for greater transparency and customization in meeting specific quality and volume requirements. Additionally, direct sales facilitate faster response times to market demand fluctuations and regulatory changes, strengthening producer competitiveness and driving growth in the bioethanol market.

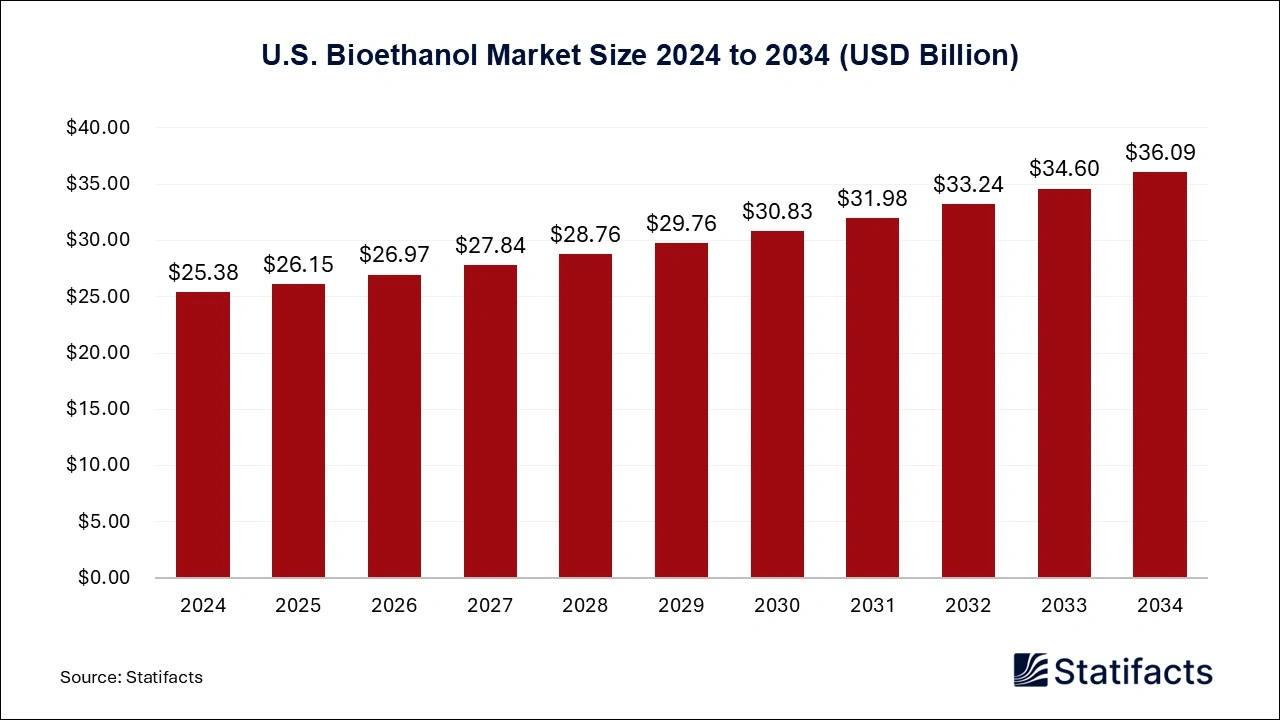

U.S. Bioethanol Market Size 2024 to 2034 (USD Billion)

The global U.S. bioethanol market size was evaluated at USD 25.38 billion in 2024 and is expected to grow around USD 36.09 billion by 2034, registering a CAGR of 3.58% from 2025 to 2034.

North America held the largest share of the bioethanol market in 2024 due to its fuel prices, energy security, abundance of agriculture, technological advancements, government incentives, and environmental consciousness, which are driving the growth of the market in the North American region. North America uses bioethanol as a primary additive to gasoline. The United States is a leading global producer and consumer due to large-scale farming. The United States is the world’s largest producer of ethanol, nearly 16 billion gallons in 2017 alone.

The U.S. is a major player in the regional market primarily due to its large-scale corn production, which serves as the main feedstock for bioethanol, along with well-established infrastructure and supportive government policies like the Renewable Fuel Standard (RFS) that mandate ethanol blending in gasoline. Additionally, the country’s extensive network of ethanol plants, technological advancements in production efficiency, and strong demand from the transportation fuel sector further solidify its leadership.

Asia Pacific is projected to host the fastest-growing market in the coming years. Government initiatives for research and development, suitable regulatory measures, and growing dependence on reducing greenhouse gas emissions contribute to the growth of the bioethanol market in the Asia Pacific region. The region’s strong agricultural resources have led to a consistent and affordable feedstock supply, including sugarcane and corn. The supportive government policies in promoting ethanol blending for fuel and regional rapid efforts in reducing fossil fuel dependence and combating air pollution further contribute to the market growth.

Browse More Research Reports:

- The U.S. starch-based bioethanol market size surpassed USD 6.1 billion in 2024 and is predicted to reach around USD 8.77 billion by 2034, registering a CAGR of 3.69% from 2025 to 2034.

- The US sugar-based bioethanol market size was evaluated at USD 11.29 billion in 2024 and is expected to grow around USD 16.37 billion by 2034, registering a CAGR of 3.78% from 2025 to 2034.

- The global phenoxyethanol market size accounted for USD 1,747 million in 2024 and is predicted to touch around USD 2,394 million by 2034, growing at a CAGR of 3.2% from 2024 to 2034.

- The global phenylethanol market size accounted for USD 1,950 million in 2024 and is expected to exceed around USD 3,030 million by 2034, growing at a CAGR of 4.5% from 2024 to 2034.

- The global diethanolamine Market size is projected to reach USD 21.22 billion by 2034 at a CAGR of 4.9%, driven by industrial, agricultural, and personal care applications.

Ready to Dive Deeper? Visit Here to Buy Databook & In-depth Report Now@ https://www.statifacts.com/order-databook/8454

Competitive Landscape in the Bioethanol Market

- Sekab Biofuels & Chemicals AB (Sweden) - provides sustainable, food-grade ethanol for beverage and pharmaceutical use.

- The Andersons Inc. (US) - offers high-purity ethanol for food and beverage markets.

- Pacific Ethanol (US) (now Alto Ingredients) - supplies specialty alcohols for beverages and flavors.

- Flint Hills Resources (US) - produces ethanol that meets strict purity standards for food applications.

- Tereos (France) - delivers sugar-based ethanol tailored for the food and beverage sector.

- Raízen (Brazil) - offers food-grade ethanol derived from sugarcane.

- Valero Energy Corporation (US) - manufactures ethanol suitable for food and beverage blending.

- Green Plains (US) - produces high-purity alcohols for the food and beverage industries.

- POET LLC (US) - supplies ethanol used in beverage and flavor extraction.

- Archer Daniels Midland (US) - provides food-grade bioethanol widely used in beverage production and food processing.

Kindly use the following link to access our scheduled meeting@ https://www.statifacts.com/schedule-meeting

Recent Developments

- In October 2024, a pilot project for sorghum cultivation to be used as bioethanol feedstock, thereby reducing reliance on imported wheat and other grains, was launched by Indonesia’s state-owned oil company, Pertamina, in response to the new government’s energy self-sufficiency policy. The company is also planning to advance its capabilities in petrochemicals, geothermal energy, and carbon capture technologies to achieve its decarbonization goals.

Source: Reccessary

- In July 2025, the start of commercial production at a 200-kiloliter-per-day (KLPD) grain-based ethanol facility within the Hamira in Punjab was announced by Jagatjit Industries Ltd. At full capacity, it could supply up to 65-70 million liters of ethanol per year, directly supporting the government’s 20% ethanol blending target under the National Policy on Biofuels. According to the company's full capacity running, the facility is projected to achieve around Rs 550 crore annual turnover.

Source: Chini Mandi

Bioethanol Market Segments Covered in the Report

By Feedstock Type

- Sugar-based Bioethanol

- Sugarcane

- Sugar beet

- Sweet sorghum

- Starch-based Bioethanol

- Corn

- Wheat

- Barley

- Cassava

- Cellulosic Bioethanol

- Agricultural residues

- Forestry residues

- Energy crops

- Municipal solid waste

- Algal Bioethanol

- Microalgae

- Macroalgae

By Blend Type

- E5 (5% Ethanol, 95% Gasoline)

- E10 (10% Ethanol, 90% Gasoline)

- E15 (15% Ethanol, 85% Gasoline)

- E85 (85% Ethanol, 15% Gasoline)

- E100 (100% Ethanol, Flex-fuel vehicles)

By Production Technology

- Dry Milling

- Wet Milling

- Cellulosic Fermentation

- Gasification and Fermentation

By End-use Industry

- Transportation

- Passenger Vehicle

- Commercial Vehicle

- Aviation

- Marine

- Power Generation (Ethanol-based Power Plants)

- Pharmaceuticals & Personal Care

- Sanitizers

- Medicines

- Cosmetics

- Food & Beverages

- Alcoholic Beverages

- Preservatives

- Chemical Industry

- Solvents

- Bio-based Chemicals

By Distribution Channel

- Direct Sales

- Third Party Distributors

- Retail Fuel Stations

- Online Sales

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

You can place an order or ask any questions, please feel free to contact us at sales@statifacts.com

Statifacts offers subscription services for data and analytics insights. This page provides options to explore and purchase a subscription tailored to your needs, granting access to valuable statistical resources and tools. Access here - https://www.statifacts.com/get-a-subscription

Contact US

- Ballindamm 22, 20095 Hamburg, Germany

- Web: https://www.statifacts.com/

-

Europe: +44 7383 092 044

About US

Statifacts is a leading provider of comprehensive market research and analytics services, offering over 1,000,000 market and custoer data sets across various industries. Their platform enables businesses to make informed strategic decisions by providing full access to statistics, downloadable in formats such as XLS, PDF, and PNG.

Our Trusted Data Partners:

Precedence Research | Towards Healthcare | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Dental | Towards EV Solutions | Nova One Advisor

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.